Rent reporting is when your rent payments are reported to credit bureaus like Equifax, Experian, and TransUnion. This can help improve your credit score by showing a history of on-time payments. In this article, you’ll learn how rent reporting works, its benefits and risks, and how to get started with it.

Key Takeaways

Rent reporting services allow renters to have on-time rental payments reported to credit bureaus, potentially improving their credit scores significantly.

Choosing the right rent reporting service is crucial; renters should consider aspects like fees, the credit bureaus reported to, and the inclusion of past rent payments for maximum benefits.

Regular rent reporting benefits both renters and property owners by incentivizing timely payments, enhancing credit profiles, and improving landlord-tenant relationships.

Join the Wait List and Get 50% Off Your Subscription

Understanding Rent Reporting

Rent reporting is the process of reporting rental payments to credit bureaus, a practice that both housing providers and renters can engage in. This process involves documenting rent payments and submitting them to major credit bureaus like Equifax, Experian, and TransUnion. This inclusion impacts your credit score under specific models like VantageScore 4.0 and FICO Score 9.

The potential for rent reporting to improve credit scores is substantial. Regularly reporting on-time rent payments can lead to an increase in credit scores, making it easier to access favorable financial opportunities. A strong credit profile, bolstered by positive rent payment history, allows for better preparedness and control during unexpected life events such as job changes or relocations. Moreover, enrolling in a rent-reporting service like RentCred can ensure your rental payments are counted towards your credit score.

However, it’s essential to note that not only positive payments are reported. If a landlord reports missed rent payments, it can negatively impact a tenant’s credit score. Therefore, rent reporting is especially beneficial for those aiming to build or enhance their credit history without additional debt.

The process includes verifying rent payments by directly contacting landlords or property managers to maintain accuracy.

How Rent Payments Impact Your Credit Score

Your credit score is a reflection of your financial responsibility, and one of the most significant factors influencing it is your payment history, which makes up 35% of your overall FICO Score. On-time rent payments can positively impact your credit scores by enhancing your payment history. This means that consistently paying your rent on time can improve your credit score and, consequently, your credit report.

However, the opposite is also true. Negative impacts on your credit scores can occur from late or unpaid rent, especially if these are reported to collection agencies. Thus, ensuring your rent payments are reported accurately and timely is crucial. Rent reporting services can help ensure that your rent payment history is acknowledged by the three major credit bureaus, thus reflecting your reliability in your credit file.

Including rent payment information in your credit report can also make a significant difference when applying for loans, such as car loans or mortgages. With rent payment information boosting your credit score, you may find yourself in a better position to secure favorable loan terms and save money over time.

Methods to Report Rent Payments

Various methods are available to report your rent payments, each with its own set of advantages and considerations. Renters can choose between landlord-provided reporting services and paid rent reporting services, depending on their specific needs and circumstances. Currently, less than 5% of renters have their rent payments reported to credit bureaus, making it a largely untapped opportunity.

When selecting a rent-reporting service, it’s essential to inquire about total costs, data protection, the specific credit bureaus the service reports to, access to credit score updates, information reporting timing, cancellation policies, and dispute handling procedures. This will help you choose a service that best fits your needs and maximizes the benefits of having your rent payment history acknowledged.

Landlord-Provided Reporting Services

Landlord-provided reporting services are a convenient option for many renters. These services enable automatic reporting of rent payments for tenants, making the process seamless and efficient. Landlords can use platforms like PayRent to report tenant payments to major credit bureaus, ensuring that rent payment information is accurately reflected in tenants’ credit reports.

This method not only benefits tenants by helping them build their credit history but also aids landlords in improving rent payment tracking. Accurate reporting can significantly enhance tenant credit scores through consistent and reliable documentation of rental payments.

Furthermore, landlords who offer these services may find it easier to attract and retain responsible tenants who are keen on building their credit profiles. By leveraging landlord-provided reporting services, both property managers and residents can enjoy a mutually beneficial relationship.

Tenants gain the advantage of having their on-time rent payments recognized by credit bureaus, while landlords benefit from enhanced payment reliability and reduced delinquencies.

Paid Rent Reporting Services

Paid rent reporting services offer another avenue for tenants to ensure their rent payments are reported to credit bureaus. These services typically involve a setup fee and a monthly reporting fee.

Additionally, paid services often provide the option for back rent reporting, allowing tenants to report past rent payments for an additional fee. This can be particularly useful for individuals looking to establish or enhance their credit history quickly. Back rent reporting fees can be around $49.95.

These services offer features that can significantly enhance credit building efforts for renters. By ensuring that rent payments are consistently and accurately reported, tenants can see improvements in their credit scores over time, making it easier to qualify for loans and other financial products.

Choosing the Right Rent Reporting Service

Choosing the right rent reporting service is crucial for maximizing the benefits of having your rent payments acknowledged by credit bureaus. When evaluating different services, it’s important to consider the costs and benefits, including setup fees and the duration of the service. Understanding these factors will help you make an informed decision that aligns with your financial goals.

Another critical aspect to consider is which credit bureaus the service reports to. Some services may only report to one or two bureaus, while others may report to all three major credit bureaus, maximizing the potential impact on your credit score. Ensuring that your rent payment history is reflected across all major bureaus can provide a more comprehensive boost to your credit profile.

Make sure to verify if your property manager is currently utilizing a rent-reporting service. This information could be important for your rental experience. If they do, you might be able to enroll in the service without incurring additional costs, making it a convenient and cost-effective option for improving your credit score.

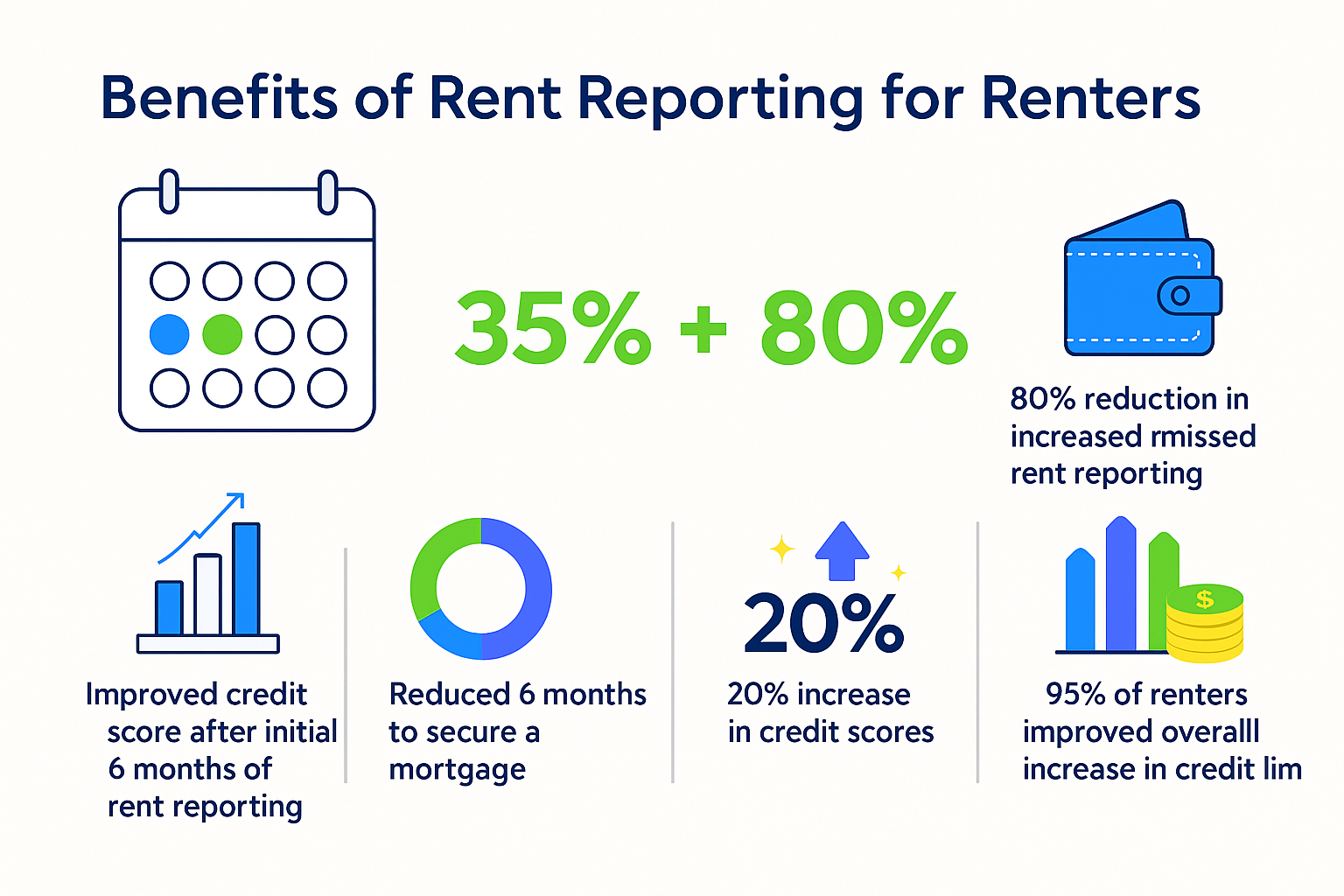

Benefits of Rent Reporting for Renters

Rent reporting offers numerous benefits for renters, particularly those with limited or no credit history. By regularly reporting on-time rent payments, tenants can quickly establish a credit history, which is essential for accessing various financial opportunities. For new borrowers, this can be a significant advantage, allowing them to build their credit profiles without taking on additional debt.

On average, incorporating rent payments into credit reports can lead to an increase of nearly 60 points in tenants’ credit scores. This improvement can make it easier for renters to qualify for loans and credit cards, offering better terms and interest rates due to an enhanced credit profile.

Additionally, rent-reporting services can help improve credit recovery for those with prior credit issues by making their on-time payments visible to credit bureaus. Overall, rent reporting can provide a straightforward and effective way for tenants to boost their credit scores and access better financial opportunities. By ensuring that their rental payment information is accurately reported, renters can enjoy the long-term benefits of a stronger credit profile.

Benefits of Rent Reporting for Property Owners

For property owners, rent reporting offers several compelling benefits. Regular rent reporting can incentivize tenants to make timely payments, reducing late payments and improving landlord cash flow. This timely payment behavior can significantly lower delinquencies and evictions, providing a more stable and predictable income stream for property owners.

Research indicates that a significant number of renters are more likely to make timely payments when those payments are reported, highlighting the positive impact of positive rent payments on tenant behavior. By fostering a culture of timely payments, landlords can create a more reliable and financially secure rental environment.

Furthermore, rent reporting can strengthen the landlord-tenant relationship. Tenants who see the benefits of having their rent payments acknowledged in their credit reports are more likely to view their landlords positively, leading to improved tenant retention and satisfaction. This mutually beneficial arrangement can enhance the overall rental experience for both parties.

Historical Rent Reporting

Historical rent reporting allows tenants to report past rent payments, helping them establish a solid payment history and improve their credit scores. Tenants can report rent payments from the last two years, providing a substantial boost to their credit profiles. This option is especially beneficial for individuals with limited credit history, enabling them to begin building their credit profiles more effectively and report rent payment history.

Using a rent reporting service can help transform regular rent payments into a positive credit account, making it easier for tenants to demonstrate their financial reliability. Choosing a service that reports rent payments to all three major credit bureaus ensures comprehensive recognition of your rent payment history.

The process of building credit through rent reporting is gradual, typically taking several months to see substantial effects. However, the long-term benefits of improved credit scores and enhanced financial opportunities make it a worthwhile investment for many renters.

Steps to Get Started with Rent Reporting

Getting started with rent reporting involves a few straightforward steps. First, determine the method for reporting your rental payments. Evaluate your options carefully before proceeding. You can choose between landlord-provided reporting services or paid rent reporting services to report rental payments, depending on your specific needs and circumstances. Each method has its own set of advantages, so consider which option best aligns with your goals.

Next, consider which credit bureaus will be reported to and which scores count those payments. Understanding these factors will help you make an informed decision and maximize the potential impact on your credit score.

Following these steps will initiate the process of having your rent payments acknowledged by credit bureaus, aiding in building a stronger credit profile.

Summary

In summary, rent reporting offers a valuable opportunity for renters to enhance their credit profiles by having their rent payments acknowledged by major credit bureaus. Whether through landlord-provided services or paid rent reporting services, tenants can benefit from improved credit scores and better financial opportunities. Property owners also stand to gain from increased tenant reliability and improved cash flow.

The journey to maximizing your credit score with rent reporting is straightforward and rewarding. By taking the steps to report your rent payments, you can unlock a world of financial opportunities and build a stronger credit profile. Don’t miss out on the benefits of rent reporting – start today and take control of your financial future.

Frequently Asked Questions

What is rent reporting?

Rent reporting refers to the practice of sending rental payment information to credit bureaus, which can enhance your credit score by incorporating your history of rent payments into your credit report.

How do rent payments impact my credit score?

Timely rent payments can enhance your credit score by positively influencing your payment history, a key component of credit scoring models such as FICO Score 9. This demonstrates reliability to potential creditors.

What methods are available to report rent payments?

Rent payments can be reported through landlord-provided reporting services or dedicated rent reporting services, each offering unique advantages and associated costs. It is advisable to evaluate these options to determine the most suitable method for your situation.

What are the benefits of rent reporting for renters?

Rent reporting benefits renters by helping them build a credit history and improve their credit scores, which can lead to better loan and credit card terms. This can significantly enhance their financial opportunities.

How can I get started with rent reporting?

To get started with rent reporting, determine your preferred reporting method and which credit bureaus are utilized by the service to enhance your credit score potential. This strategic choice will facilitate a positive impact on your financial profile.

Leave a Reply